Short links this week, not much caught my eye as particularly good. These three are the exception, and I think they are exceptionally good.

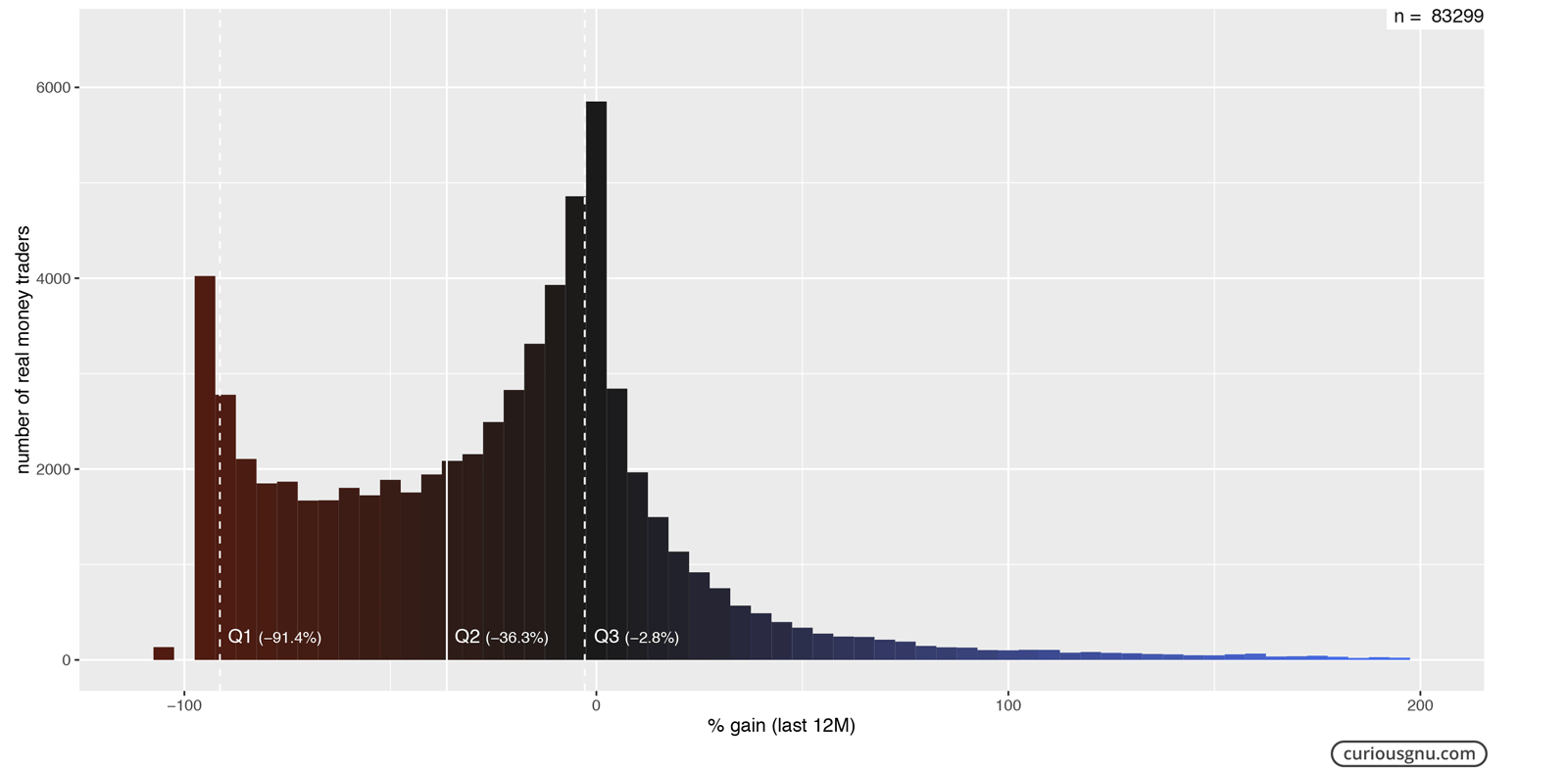

- CuriousGnu post on the profitability of day traders: Admittedly, this post is based off of what I would call extremely anecdotal data, but is compelling nonetheless. You’ll see in the data from the graph below — about 80% of people lost money over 12 months. There are a million follow-up questions, but this confirms about what one might expect this distribution should look like. Lots of people who lost everything on presumably high leverage or highly concentrated bets, a lot of people who were burned down by transaction costs, and then a general grouping around 0% for people who had decent bankroll management, but for whom investing is essentially a zero-sum game. More than anything, this post (and the others on the website) are great encouragement to learn the basic programming needed to scrape data.

- This discussion between Gene Fama and Richard Thaler is about 45 days old, but I just found it (h/t David Henderson), and is well worth the watch/read: The competing schools of thought — taking essentially opposite views of whether ‘bubbles’ exist as generally defined. Both players are involved in the crossover between economics and finance, i.e., their works are directly applicable to investing.

Fama: I’m an economist. Economics is behavioral, no doubt about it. The difference is your concern is irrational behavior; mine is just behavior.

- Another David Henderson h/t, this video on the economics of sweatshops is a great watch. Being able to simultaneously hope for better future outcomes for developing countries and recognizing that ‘sweatshops’ are part of those better outcomes is a skill worth developing.

Sign up for links to your inbox below:

[newsletters_subscribe list=”1″]