Unless you’re an American, in which case you are still too patriotic, but much less patriotic than people from other countries.

The tendency to invest in your own country’s assets is known as home bias.

I’m writing about home bias because recently, when I was on vacation in Seattle (and watching the best DotA players in the world), it occurred to me that I have no idea how much of a portfolio a person in a country not called America is supposed to have in their home market versus the rest of the world. Americans routinely have foreign equity exposure of something like 20-40% of their equity portfolios. That strikes me as very reasonable from a gut-check level. On the other hand, I have no idea how much people from, for instance, England, France, Japan, or Australia have in their portfolios, I have no idea what is recommended by professional advisors, and I have no idea what is theoretically optimal.

I pondered for a few weeks after I got back, then I started looking. As far as google — about all I could find was a bunch of USA-centric portfolios that were ‘adapted’ for other countries (replacing the S&P 500 with the FTSE 100, for instance), something struck me as obviously inappropriate given the relative sizes of our economies.

A little further research provided me with almost nothing in the way of recommendations from professionals (although it was incredibly easy to find free high quality advice for Americans). I’ll disclaim now — while I’m usually pretty good at interneting, it is possible I missed some obvious sources or that the sources I was seeking did not show up because I’m in America.

However, fortunately for us mortals, what financial advisors have seriously neglected, economists have been puzzling over for years.

To bring us all up to speed:

Why own foreign stocks?

From the point of view of a US investor, it’s easy to see foreign equities as a needlessly risky, speculative investment. Somehow Americans have come to accept our whole country as our home base when it comes to investments. This is a huge advantage. I can easily imagine a world where Texans invest mostly in Texas and Californians in California, etc. When you take the view of someone from any other country in the world, it becomes much easier to see why global diversification is desirable — most countries don’t have economies that are very big nor industries that are sufficiently varied.

What do the Nobel Prize winners say?

Most models [sources needed] that attempt to suggest a theoretically optimal portfolio suggest that investors should hold a portion of the pro-rata investments of the world (i.e., if the US market and Japanese markets were the only two in the world, and the US market were three times the size of the Japanese, you would hold a portfolio made up of 75% US holdings and 25% Japanese holdings. If you wanted less risk, you’d hold them in the same proportions, but allocate some of your funds to a “risk-less asset” (typically US treasuries in most literature). If you wanted more risk, you’d leverage up. However, investors do not do this in real life. There are numerous theories why, and I have my own thoughts, but it is certainly not a settled issue as to what should be recommended.

What are people actually doing?

Fair enough — it’s difficult to estimate returns:

((http://www.nber.org/papers/w3609.pdf))

((http://www.nber.org/papers/w3609.pdf))

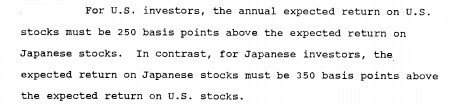

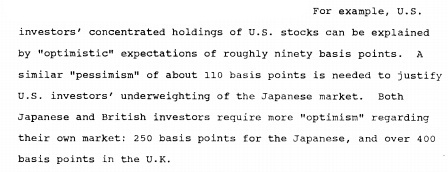

So what do people do? They assume that their home market will outperform.

((http://www.nber.org/papers/w3609.pdf))

((http://www.nber.org/papers/w3609.pdf))

Pretty painful mistake to make for 1991 Japan.

((http://www.nber.org/papers/w3609.pdf))

((http://www.nber.org/papers/w3609.pdf))

American investors seem so reasonable by contrast.

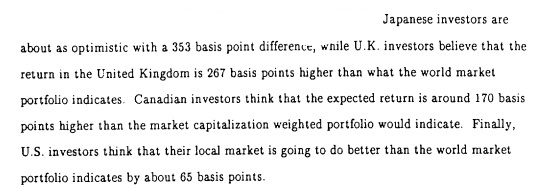

One more:

((http://www.nber.org/papers/w4218.pdf))

((http://www.nber.org/papers/w4218.pdf))

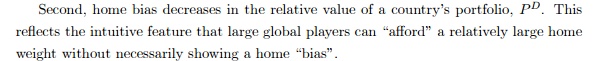

Okay, okay, but who can afford to have home bias?

((https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp685.pdf))

((https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp685.pdf))

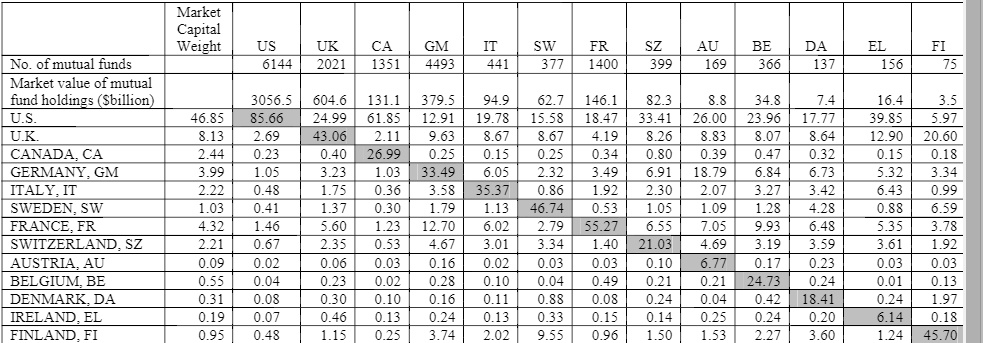

Well, what do the numbers look like? The numbers in grey are the actual allocations of the countries listed in the same row — the numbers in the first column are the actual size of the country, e.g., US investors invest 86% of their assets at home, but US assets only make up 47% of the ‘global portfolio.

((http://www.researchgate.net/publication/4992708_What_Determines_the_Domestic_Bias_and_Foreign_Bias_Evidence_from_Mutual_Fund_Equity_Allocations_Worldwide))

((http://www.researchgate.net/publication/4992708_What_Determines_the_Domestic_Bias_and_Foreign_Bias_Evidence_from_Mutual_Fund_Equity_Allocations_Worldwide))

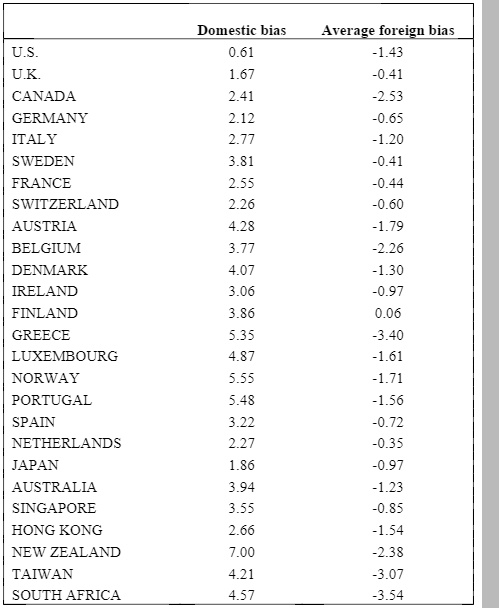

These numbers are very nice, but how can we do an apples to apples comparison? Here’s one study’s attempt at ‘bias ratings’.

((http://www.researchgate.net/publication/4992708_What_Determines_the_Domestic_Bias_and_Foreign_Bias_Evidence_from_Mutual_Fund_Equity_Allocations_Worldwide))

((http://www.researchgate.net/publication/4992708_What_Determines_the_Domestic_Bias_and_Foreign_Bias_Evidence_from_Mutual_Fund_Equity_Allocations_Worldwide))

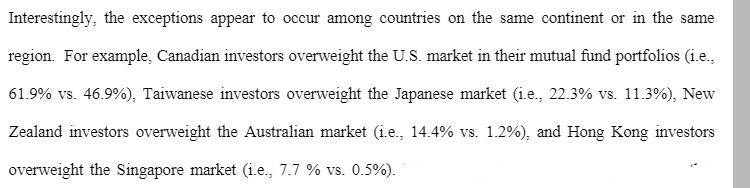

By now you’re probably convinced that home bias exists. Does it extend to familiar, but less immediate areas? Why yes, yes it does.

((http://www.researchgate.net/publication/4992708_What_Determines_the_Domestic_Bias_and_Foreign_Bias_Evidence_from_Mutual_Fund_Equity_Allocations_Worldwide))

((http://www.researchgate.net/publication/4992708_What_Determines_the_Domestic_Bias_and_Foreign_Bias_Evidence_from_Mutual_Fund_Equity_Allocations_Worldwide))

A few more (great) illustrations:

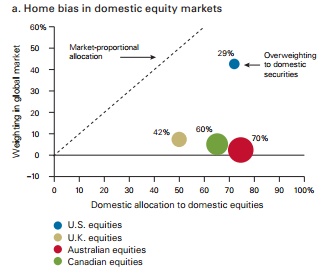

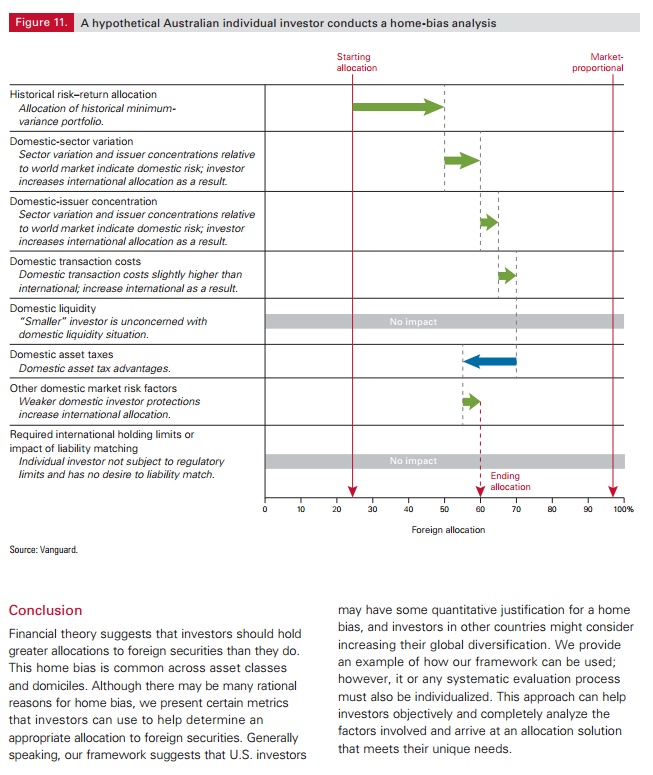

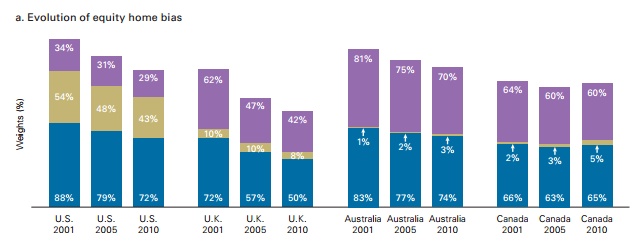

Home equity bias over time (in four different areas). Note, ratio of purple to yellow is the bias. Only one even comes close to theoretically efficient allocation on a relative basis, though they are all pretty far from what you’d expect on an absolute basis. Begs the question of whether there is another factor that should affect asset allocation preferences.

![]() ((https://personal.vanguard.com/pdf/icrrhb.pdf))

((https://personal.vanguard.com/pdf/icrrhb.pdf))

Domestic allocation bubbles versus a theoretical line — the farther from the line a bubble is, the further from optimal the allocation:

((https://personal.vanguard.com/pdf/icrrhb.pdf))

((https://personal.vanguard.com/pdf/icrrhb.pdf))

Minimum variance portfolios:

So obviously, people are not doing what economists expect them to. People are not theoretical.

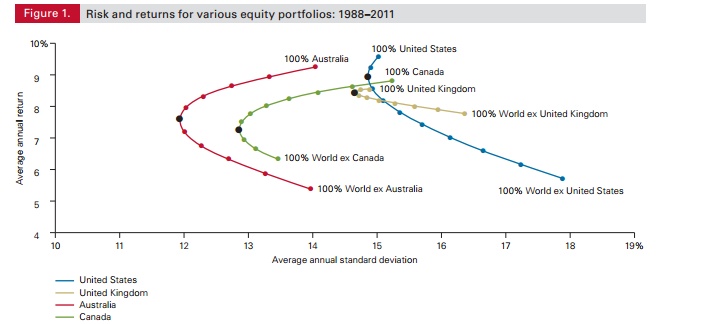

If you’re familiar with building efficient portfolios, this next graph will be very interesting:

((https://personal.vanguard.com/pdf/icrrhb.pdf))

((https://personal.vanguard.com/pdf/icrrhb.pdf))

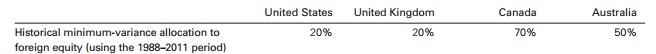

In numeric form, it basically says that if you’re from the US, or perhaps the UK, some light diversification would be useful to a portfolio built around your ‘home assets’. Canada and Australia could use more (although the Australia line is pretty sexy on a risk adjusted basis).

((https://personal.vanguard.com/pdf/icrrhb.pdf))

((https://personal.vanguard.com/pdf/icrrhb.pdf))

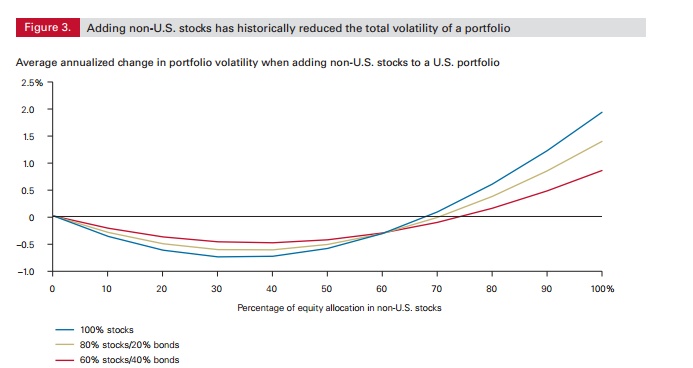

Finally, for a US portfolio, how much foreign equity makes sense? To achieve minimum volatility, somewhere between 20-40% appears optimal.

((https://personal.vanguard.com/pdf/icriecr.pdf))

((https://personal.vanguard.com/pdf/icriecr.pdf))

My preferred theory:

The older, and hopefully wiser, I get, the more I assume that people’s intuitions are correct. My doubts about their analysis remain, but even if the US and the rest of the world can’t put their finger on why they prefer their ‘home bias’, I think they are onto something, and economists are being just a tad naive if they insist everyone is allocating in error. My pet theory has some support. The general idea is that, since most things you must buy, live in, and sell are more highly correlated with your home country, that living somewhere should engender a natural ‘hedge’ via investing more heavily than theoretically optimal for a person who would move countries at a moment’s notice.

((https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp685.pdf))

((https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp685.pdf))

Slightly deeper:

((http://www.nber.org/papers/w5784.pdf))

((http://www.nber.org/papers/w5784.pdf))

Conclusions:

The real question is, given all of the above, how should your assets be allocated?

One of the papers was kind enough to have data on biases. If you’re young, it is worth bearing in mind:

((http://www.waseda.jp/wnfs/pdf/labo3_2008/WIF-08-002.pdf))

((http://www.waseda.jp/wnfs/pdf/labo3_2008/WIF-08-002.pdf))

Jack Bogle said, somewhat recently, that he doesn’t see much reason to invest outside the US. If you ask me, that goes against almost everything that Jack Bogle ever stood for, and I mostly attribute it to his old age and decreasing risk tolerance. I.e, I think he’s wrong, and wrong at a fundamental level.

Vanguard has some conclusions — mostly that US investors are probably not making huge mistakes, but that investors in other countries probably are:

((https://personal.vanguard.com/pdf/icrrhb.pdf))

((https://personal.vanguard.com/pdf/icrrhb.pdf))

Another Vanguard white paper concludes that US investors should allocate between 20-40% of their equities to non-US stocks.

((https://personal.vanguard.com/pdf/icriecr.pdf))

((https://personal.vanguard.com/pdf/icriecr.pdf))

I agree, but that wasn’t ever really the answer I was seeking — most financial advisors and prudent allocation examples would probably recommend right in that ballpark. The real question is how to allocate for non-US investors.

My thoughts are:

People tend toward the correct answer. If economic theory says they are way off, my tendency is to believe that the answer is somewhere in the middle. People are probably relying too strongly on their rules of thumb/comfortable tendencies. Economics is probably oversimplifying the issue and ignoring a big factor.

Vanguard gives a great sample of how to assess the proper foreign allocation:

((https://personal.vanguard.com/pdf/icrrhb.pdf))

((https://personal.vanguard.com/pdf/icrrhb.pdf))

If we go all the way back to the allocations of different countries, we find some interesting data. Most large countries allocate somewhere between 20-60% of their portfolios to their own equities.

If you’ve been reading, you are probably convinced that this is too high. My guess is that this is too high by something like double. If you are from the UK and your market cap weight should be around 10%, but you are really allocating around 40%; 25% is probably a happy medium that incorporates the fact that you’d like to remain in the UK and are willing to hedge to that effect. In a truly small country (e.g., Sweden), I’d posit (with much hand waving and not a lot of math) a 15% allocation is defensible on hedging principles. Hopefully more good work will be done on this issue.

From there, perhaps another portion of allocation equal to the home country allocation (up to a 25% cap), can be allocated to the greater economic region. Based on the same hedging principles. If you’re in a European country, that’s Europe. This will help you get proper country and sector diversification — most countries outside of the US can’t offer that.

Allocate the rest to the rest of the world, somewhat proportionate to the size the markets.

For example, if you’re from most non-UK countries in Europe, a 15% allocation to your home country, a further 15% to the rest of Europe, a 30% allocation to the US, and a 40% allocation to the rest of the world is probably an appropriate place to start.

Over time, I expect to see allocations to home countries continue to decline toward 15-20%.

Pingback: Jack’s Links – The Zeitgeist Log