It seems obvious to the point of absurdity when you spell it out, but there are two things you can do with your income; spend it or save it.

For most people, the division of spending and savings (what is known as your ‘savings rate’) is the biggest factor that is going to determine when you can retire and comfortably maintain your standard of living.

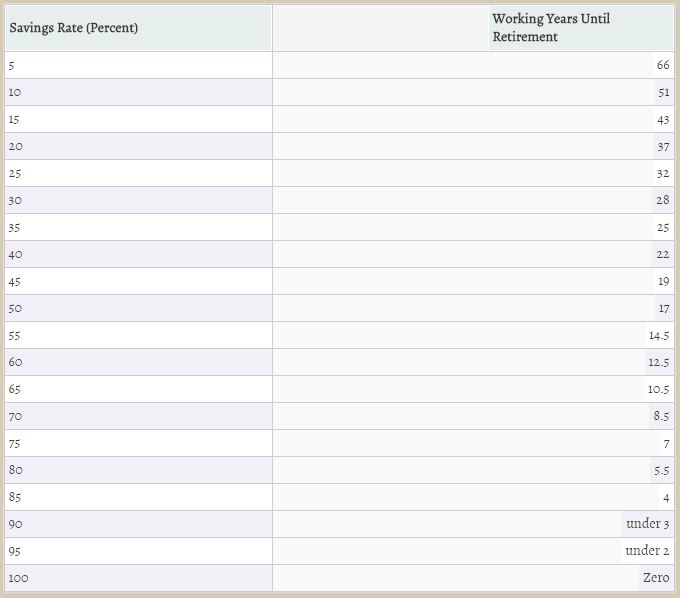

Noted financial independence homie, Mr. Money Mustache (MMM), created this nifty little table (click for the full article and underlying assumptions, but I generally find them reasonable and conservative).

So given this, it’s pretty obvious that most people want to shoot for the 20-30% savings range in most years. That gives you a chance to be able to retire in your 50s at something like your average lifestyle during that period.

Now there are some huge oversimplifications here — most people’s incomes increase over time, most people’s cost of living increases over time (at least until kids are on their own), and most people’s savings rates won’t be steady year to year. Then there are the even trickier (but less important) questions of how to calculate your savings rate (Roth vs. Traditional? What about taxable accounts?). These are often dismissed and people say to just add up the savings vs. the income, but that’s pretty bad, too, because obviously a ‘Roth dollar’ is worth way more than a yet-to-be-taxed ‘traditional dollar’.

Okay, okay, so the chart isn’t perfect, but if your cash comp at work is $100k and $30k ends up in one or another account by the end of the year, you’re doing pretty well.

The argument is also frequently made (including in the MMM article linked earlier) that reducing spending is more powerful than increasing income. While technically true in the strictest sense (because you save a dollar and also don’t spend it each year), it ignores pretty much all of the laws of marginal utility, and certainly doesn’t apply if part of one’s goals are to have an increasingly more comfortable lifestyle as they can afford it.

Anyway, the point here is that there are general rules of thumb for going in the right direction, but since most people don’t (and can’t) yet know their final desired destination, there’s no right and wrong, just a math equation.