- James Osborne at Bason Asset with a post about the (lack of?) scaling of AUM fees: While I agree that we’ll see some people seize the opportunity to be different (either by scaling down costs aggressively after some AUM mark or by being “flat fee”), I think there is an alternative thesis that is along the lines of: people with much more money (5-10 million+) are willing to pay more for higher-end service, more contact, more support, etc.

if they go [and] interview 5 advisors they will see 5 fee schedules that are practically indistinguishable.

- Michael Kitces on The Problem of Joint Ownership of An Annuity: as if people need another reason not to own a deferred annuity…

With a jointly owned annuity, the death of the FIRST owner triggers RMDs!

- Ben Carlson at A Wealth of Common Sense with a post on pension investment return assumptions: some pretty shocking numbers in here.

Based on the latest NASRA survey data, just 5% or so of these pensions assume returns will come in below 7% annually.

- More Kitces, this time on Empty Nesters saving for retirement to make up for lost ground during the child-rearing years: I absolutely love posts like this that line up more with real life — there’s nothing wrong with telling people to target 15% savings rates, but nobody is going to be able to hit that target every single year with all of the ways that life changes.

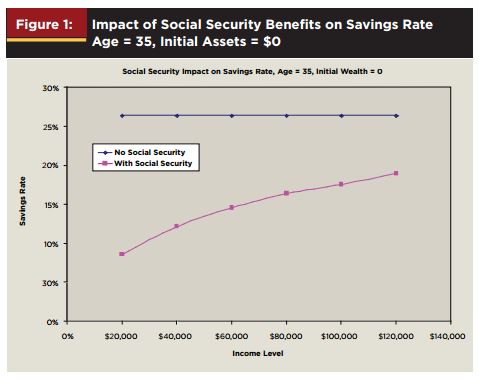

- From the above Kitces article (h/t, Michael), a morningstar paper on savings guidelines which was pretty fun to dig through.

- Scott Sumner on Why most regulations are harmful:

We’d be better off passing a law sun-setting all regs, and the entire Federal tax code, in 2025. Then give Congress the next 9 years to set about re-passing all the regs and taxes that actually make sense.

If you want the best links on the internet straight to your email, just sign up below.

[newsletters_subscribe list=”1″]